Recently, folks suggested that social business space was getting washed out, especially with Social Media Week spreading across the globe and being hosted at many corporations. Yet despite the interesting and activity around this topic, many folks are confused around what maturity really looks like. Managing a Facebook page to promote the latest campaign isn’t really social business, it’s just social added to existing interactive marketing.

I was talking with industry peer Michael Brito (former Intel and now at Edelman) about the maturity of the space at Cisco’s social media week yesterday, and we both agree this space is just heating up. But don’t listen to us, instead, let’s review a sample from a recent Altimeter Report on Social Business of what actual corporate decision makers said in a recent survey:

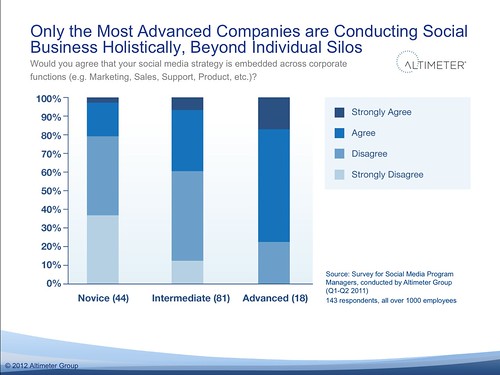

Figure 1: Only the Most Advanced Companies are Conducting Social Business Holistically, Beyond Individual Silos

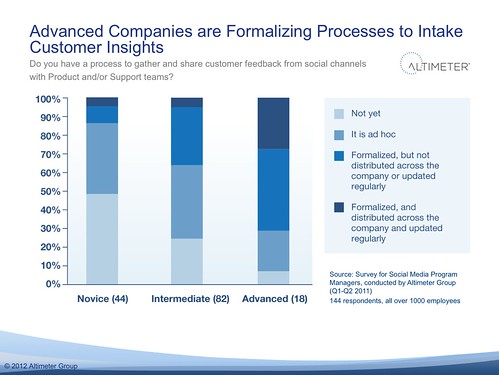

Figure 2: Advanced Companies are Formalizing Processes to Intake Customer Insights

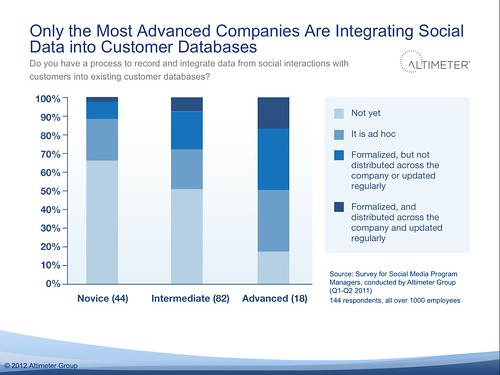

Figure 3: Only the Most Advanced Companies Are Integrating Social Data into Customer Databases

Let’s take a look at this data, to understand why the social business space is still very immature:

The Industry Isn’t Mature, Few Have Reached Advanced

Altimeter’s research often segments buyers by their maturity, as it helps to forecast future behaviors and we wanted to share this today. First note this maturity breakout of these corporations (many of which are global national) that have over 1000 employees: novice are 44, intermediate 81, and advanced are 18. Percentage wise, we see that 56% of the 143 are lumped in the intermediate stages, followed by 30% of the market in novice, and followed by the remaining advanced a mere 12% of the set. What does this mean? While most companies are past the experimentation stage, they’ve yet to roll these out across the corporation or think bigger than campaigns or specific business units.Limited Integration Across Business Units, Products, and Customer Databases

Looking at Figure 1, we can see that many companies are not even integrating this across their enterprise. We know from data that rollout usually starts in Marketing (with a segment of that being corp comm), followed by customer support who has to respond to angry clients, followed by product teams, and then low adoption for partner ecosystem and supply chain. One sign of an advance company is the ability to integrate customer feedback into the product roadmap in Figure 2. We know this is a sign of maturity as it requires both vertical approval from executives and broad approval across product lines and beyond –it’s often against the culture of many engineering groups. Lastly, in Figure 3, companies barely even have a full view of their customers in the social space, as data is siloed among brand monitoring, locked in Facebook apps, and spread among the company.Understand What Advanced Corporations Look LIke

There’s a few criteria I look for when seeing if a company is advanced beyond the three figures presented above. Nearly all employees are using social in a safe and organized way (called Holistic). Another criteria is data is being aggregated from multiple locations and the company is able to predict and anticipate what customers are going to do. Thirdly, they stop using the terms ‘social business’ and just use the term ‘business’ as this integrates into their normal digital communications. While somewhat dated (2010) I created a list of what an advanced company looks like, although I feel it needs updating in 2012.

I look forward to hearing from you, what are you seeing: Are companies starting to mature? What are your indicators?